Artificial Intelligence in Insurance: Outlook, Application, Advice

The AI hype train in insurance is huge from US agencies to carriers. You will hear about AI from insurance software vendors, consulting companies, and industry podcasters weekly. It’s an important topic, right? Right, but please, please, do not act on the fear of missing out.

This is not another article made to drip-feed you how much your company needs change and breakthrough… with a hefty consulting bill on top ASAP.

Time to get real and rational about AI – we say that as a machine-learning insurtech company, we mean it.

Can AI change the insurance industry? Absolutely.

Will you achieve success thanks to AI? Possibly.

Will the AI wave bring failures and victims? Totally.

AI in Insurance: Outlook and Statistics

Does the insurance industry consider AI and insurtech relevant? Let’s look at a few selected stats:

- 23% of CEOs expect generative AI to bring ROI within the period of 1-3 years, and 58% expect it to happen within a 3-5 year window (“KPMG 2023 Insurance CEO Outlook“, page 8)

- Disruptive technology ranks as #6 major concern of today for insurance orgnaizations, and #2 threat for the following 3 years concerning 13% of CEOs (“KPMG 2023 Insurance CEO Outlook“, pages 4-5)

- The global AI in insurance market was estimated at USD 3.64 bln in 2022 with the predicted USD 35.77 bln for 2030 (“Global Artificial Intelligence (AI) in Insurance Market – Industry Trends and Forecast to 2030” by DataBridge)

- 81% of outperforming insurance businesses surveyed have either invested in or are already working with insurtech businesses (“Friend or Foe? Insurtechs and the Global Insurance Industry” by IBM, summary)

- 80% of CIOs in insurance see added value in AI solutions, and 65% plan to invest more than USD 10 mln into AI (“Why AI in Insurance Claims and Underwriting?” by Accenture, page 10).

What To Make of These Attitudes?

AI is seen as disruptive – perceived both as an opportunity and a threat. The decision makers in the insurance industry are clearly placing its importance high, which to a degree may be owed to the prevalence of AI hype, strong media coverage, and the novelty factor premium.

The AI will stay with the industry for good in some shape, given the market predictions.

The remaining question is whether the market dynamics for AI insurtech will match the forecasts. While the boldest predictions promised >30% CAGR, some are already showing moderate 18-20% CAGR for this tech market, and the real growth may be even lighter.

Some forecasts and attitudes presented in surveys may have been (or may still be) inflated with enthusiasm.

So, take everything as any other business and tech decision.

Are there any caveats to AI in insurance? Let’s see how you can optimally benefit from AI, where you may need to stop and think, or entirely reconsider using it!

Sensible Rules for Approaching AI in Insurance

An actionable list to give you some items you should remember when touching AI solutions. These are mostly applicable to any other automation or insurtech tool you may at some point consider making a part of your operations.

The Process Comes First

It’s not about tools, and not even about quick results (much like the digital transformation in insurance). Think what exactly you are trying to change with AI, what you are aiming to improve, and whether AI the right tool. Only by understanding the given process you will realize whether and why it’s bad, or if tools can solve the issue at all.

Do you know how your business processes look in detail? Are they properly mapped? There is a chance that you can achieve great improvement without tech. As little as some reorganization and standardization can bring you wins.

ROI Happens in Various Ways

Different classes of assets create value in different ways – and so do various tools! It’s not necessarily cash or explicit direct cost reduction.

For example, it could be reducing risk, automating a manual process that creates bottlenecks elsewhere, or making your employees happier for lower turnover. Your finance department understands that, so work with them openly rather than try making up immediate ROI.

Efficiency Is NOT Effectiveness

AI can do some things fast. Yet the fact that your client support can handle more requests, or that some business process appears cheaper, doesn’t mean it’s better, or that it doesn’t harm your business elsewhere.

Efficiency is local, and focused on measuring isolated KPIs and ratios – which may be misleading.

Effectiveness is the total net positive outcome of the changes you make.

Know When To Keep It Human

Can you use AI to build genuine relationships, foster trust, and create positive experience? Could AI create problems in the place where you are trying to fit it? Can it build frustration? It is up to you whether and where it’s worth going full-AI in some area. There could be operational reasons for that.

AI is really good in analysis and information synthesis that would be too overwhelming for humans. You may consider using AI as an aid for human decisions, and an enabling interface for human interactions.

Yet remember that AI doesn’t have empathy, and it tends to be bad with handling exceptions. Clients or prospects often need reassurance, the feeling of being heard, or help in navigating negative emotions. Putting a customer behind an AI agent wall may create resentment even though things appear more efficient.

Gen AI Needs Guiding, Monitoring, and Expertise

Generative AI doesn’t replace subject-matter expertise. It still needs a safeguard of an expert, otherwise how would you know if what AI outputs is even remotely in line with facts and domain knowledge?

Generative AI tools in their current state do NOT have some ultimate knowledge and ability to reason. NLPs often need a lot of context and they are not meant to be “right” by design, instead they are trying to “get it right enough” and create plausible language, replicating its structures. (Here’s an awesome first-hand explaination.)

Now, let’s explore actual AI applications in insurance.

Popular Use Cases for AI Insurtech

AI tools are spreading in multiple areas of insurance business. AI technology is offering solutions for underwriting, claims processing, better risk assessment, core system data management, customer service, and so much more:

1. Underwriting and Risk Assessments

AI is transforming underwriting in insurance by using advanced data analytics and machine learning to improve accuracy and efficiency. By analyzing extensive datasets, AI identifies hidden patterns and provides customized strategies that help insurers make informed decisions. This proactive approach not only enhances profitability and manages risk portfolios effectively but also strengthens client trust through fair criteria and detailed assessments.

2. Producer Training

AI is a valuable tool for training new insurance agents by simulating real-world scenarios through interactive role-playing. This accelerates learning, helping agents achieve competency faster. AI-driven training ensures consistency and quality across all agents, boosting confidence and maintaining uniform training standards within the organization.

3. Submissions

AI streamlines insurance submissions by automating form filling and standardization, meeting underwriter expectations efficiently. This reduces back-and-forth communication with carriers, speeds up approval processes, and improves client presentation. By enhancing efficiency and accuracy, AI minimizes delays and optimizes the overall customer experience.

4. Operational Efficiency

AI enhances operational efficiency in insurance agencies by automating routine tasks such as data entry, document processing, and policy comparison. This reduces errors, frees up resources, and allows employees to focus on strategic tasks. By leveraging AI capabilities, agencies achieve cost savings, improve service delivery timelines, and enhance customer satisfaction.

The Unseen Data Heroes of Insurance – Listen to Our Guest Episode

Our founder, Roman Stepanenko, shares insights into challenges of data administrators and data conversion teams in insurance.

Discover the gaps in the process, and the reality of manual workflows of insurance's data people. They are some of the most hard-working and unnoticed 'silent teams'.

Data conversion analysts, business systems analysts, implementation specialists, and data admins keep large brokers going after agency acquisitions.

5. Core System Data Migrations and Conversion

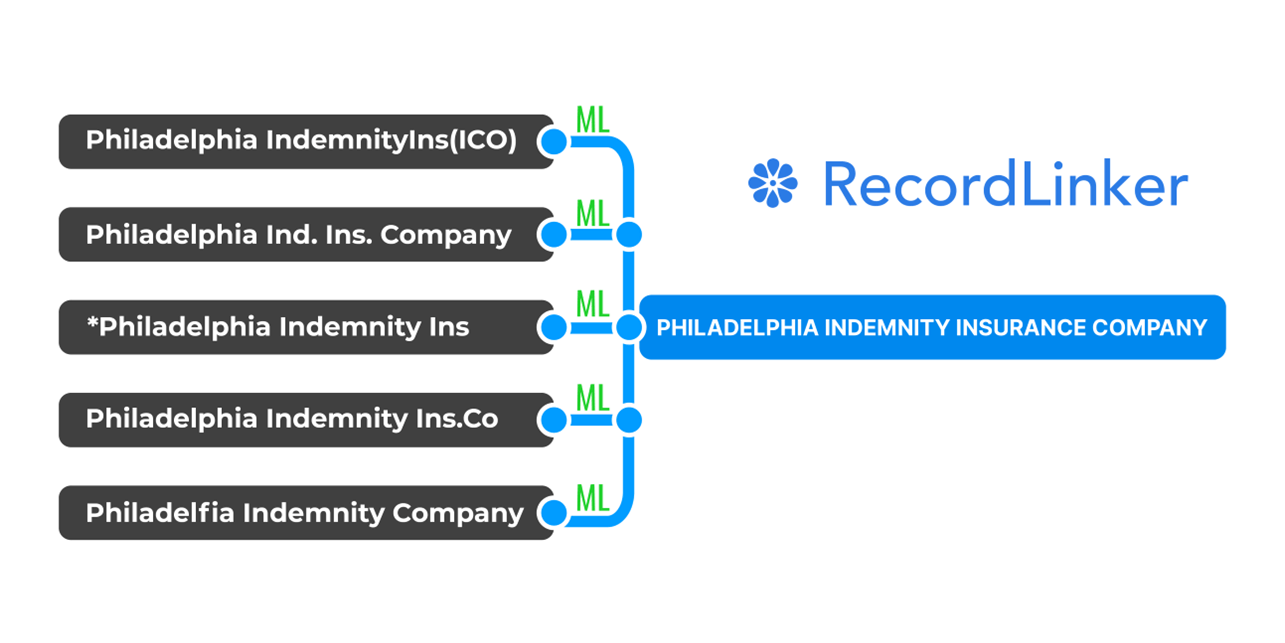

Specialized ML can match records from disparate systems to your core system’s golden record set, ensuring accurate mappings. This simplifies and speeds up system data migrations, especially during growth phases, or replatforming efforts. AI can also automate the creation of vendor CSV or Excel conversion files, eliminating the need for manual file building. This enables data conversion teams to be more productive and reduces the dependency on professional services or business process outsourcing.

Here’s a deep dive into why AMS data migrations trouble large P&C brokers, and what to do to transform data conversion as a challenging business process.

6. Data Mart Standardization

AI assists in merging and standardizing records in your data marts, enabling a holistic view of your business operations. This consolidation enhances the accuracy and effectiveness of your analytics. By ensuring that all data points are consistent and accurately reflect your business metrics, AI enables better decision-making and more insightful business intelligence. Furthermore, AI-driven data mart standardization reduces the time and effort required to clean and prepare data, allowing your data analysts to focus on generating actionable insights rather than on data wrangling.

7. Up-to-Date Core System Reference Records

AI helps you keep track of industry changes, such as agency mergers and name changes, ensuring that your core system records are always up-to-date. This maintains the accuracy and relevance of your standardized data. This is crucial for compliance, understanding where your business comes from, achieving better negotation position, and making informed business decisions. Additionally, AI can suggest corrections for outdated or incorrect data entries, improving the overall quality and trustworthiness of your core system data.

Free Book: Practical Guide to Implementing Entity Resolution

Interested in implementing an in-house record matching solution with your own development team without using any outside vendors or tools?

8. Sales Optimization

AI helps insurance agencies optimize sales by analyzing customer data for upselling and cross-selling opportunities. Predictive models identify sales trends and customer preferences, enabling personalized marketing strategies. By uncovering hidden patterns in sales data, AI enhances customer satisfaction, loyalty, and adapts strategies to changing market dynamics.

9. Enhanced Customer Service

AI-powered chatbots and virtual assistants handle routine inquiries, allowing agents to focus on complex customer issues. AI analyzes interactions to improve service quality, understand customer sentiment, and personalize customer experiences. This proactive approach builds stronger client relationships and fosters long-term loyalty.

10. Claims Processing

AI streamlines claims processing by automating updates and communication between carriers, agents, and customers. This accelerates claims verification, reduces processing times, and enhances transparency. By analyzing claims data, AI identifies trends for process optimization, further improving efficiency and customer satisfaction.

11. Fraud Detection and Mitigation

AI uses machine learning to detect anomalies and flag potential fraud in insurance claims. This proactive approach enhances fraud detection accuracy by identifying unusual patterns, reducing investigative workload. Machine learning can be continuously retrained, making it adapt to new fraud tactics, ensuring effective fraud detection and safeguarding the agency’s reputation and integrity.

Special Considerations for AI in Insurance

There are some challenges to AI getting ahold of the industry and dangers of its unintentional misuse.

The integration of AI calls for upskilling employees to effectively collaborate with AI systems, leverage their capabilities, and make employees understand the scope of misuse. Insurers should invest in training programs to enhance AI literacy among employees, fostering a culture of continuous learning and innovation.

Generative AI draws not just from the input provided by users. It also draws from the training set data. This could be an issue in underwriting – relying on gen AI to fill the gaps in data could have its consequences. Consequently, answers to open and subjective questions coming from gen AI rather than binary yes/no require special diligence and fact checks in confirming if there is any data point to back up the interpretation. There could also be other data point possibly refuting AI’s initial conclusions.

As AI assumes more significant roles in decision-making, insurers must uphold ethical standards and prepare for regulatory changes. AI algorithms must adhere to fairness and transparency principles, ensuring that decisions are based on unbiased data and ethical considerations. Robust governance frameworks should oversee AI implementation, including regular audits, explainability of AI-generated decisions, and mechanisms for addressing biases or unintended consequences.

This may as well mean reconsidering company-wide adoption of generative AI, and possibly entirely giving up on solutions exposed to regulatory changes and privacy concerns.

With a word of caution behind us, let’s think where to even look for AI insurtechs?

Getting Into AI Solutions in the Industry

Where do you even start looking for an AI insurtech vendor, or a specific solution?

There are a few ways:

1. Official Tech Partners

Did you know that system providers like Vertafore (Orange Partner Program) and Guidewire (Insurtech Vanguards) have their partner programs, or featured startup communities? You may browse through their directories, or ask your client success to connect you with a relevant partner.

These initiatives often show that their members have been recognized as a trusted part of the industry. The practical benefit of working with a partner could mean (easier) access to API, simpler integration, and resulting ability to work with a core system in a greater capaticty.

2. Insurance Conferences

Look around during industry conferences! Check out the discussion panels, or let your colleagues from another department know if they happen to participate. Then you have vendor booths and sometimes startup zones.

Core Insurance Software and Agency Management Systems usually have their conferences, so if an upgrade you want to make is system-specific, you may start with exploring around during these events.

3. Insurance Podcasts

Check out some industry podcasts from general insurance to insurtech-themed series, AI is a hot topic, and often you get to hear insights from agency owners, brokers, and tech founders.

This is both a good way to spontaneously discover new solutions and learn more about companies you have already started considering. Vertafore, Guidewire, and Duck Creek run their own podcasts, and there are dozens more active programs about insurance and insurtech run by various brokers, carriers, law firms, and consultants.

4. Insurance Business & Insurtech Consultants

You don’t neccessarily need a big corporate consultant, there is a handful of companies and individuals with pure focus in insurance, or even insurtech.

The added benefit for consultants is that they may not necessarily push you to get technology, which is a good thing. Although mileage may vary – consultants may occasionally have incentives to sell you specific solutions.

Still, you will most likely get to walk through a specific process of assessing your needs, and validating whether a solution to your problem is what you think it should be. Consultants may be a good starting point, if you feel that something is wrong in some part of your operations, but you have a problem with understanding the causes.

5. Networking & Insurance Associations

Ask around, maintain your relationships, give and ask for advice. An ex-team member who moved on may already know a perfect solution to your problem – and they most likely remember how your work is like.

When it comes to the bigger scale, there are formal professional associations your company may already be in. Especially independent agencies tend to keep together in this respect. Pay attention to their events and check their webinars. Why not be more active and ask your association for connections, or even suggest inviting guests to an official meeting?

But Is It AI, ML, NLP, or Whatever?

For the purposes of this article, we mostly used AI – because this is how the general public approaches the topic.

While being super rigid about definitions is immaterial to the outcomes you want to see in business (and boring), knowing the difference may still help you communicate with engineers and insurtech vendors’ reps. Clearing it up may ultimately help you understand what you are purchasing and what to expect on a general level.

Let’s quickly recap some definitions:

- Artificial Intelligence – the big umbrella term for anything below, it’s any technology enabling machines to learn and solve problems.

- Machine Learning – a branch of AI focused on algorithms that enable learning from data and performing tasks without being “explicitely” programmed, it’s largely based on statistical algorithms. ML is often described as being able to train itself and improve.

- Deep learning models – a sub-field of ML relying on neural networks, characterized by their design aimed at mimicking the human brain in learning and decision-making. They are trained on large data sets, resulting in their ability to identify patterns and relationships.

- Generative AI – deep learning models trained to create content based on patterns learned from robust data sets.

- Natural Language Processing (NLP) – the subdiscipline of computer science dealing with understanding human language. In the context of AI, NLPs mean deep learning models specifically focused on understanding structures behind human language and producing human-like text.

There’s a common argument that there’s no “true AI” (i.e. Artificial General Intelligence). While true, this does not help anyone in achieving anything productive. ML algorithms can be trained to perform specific tasks astonishingly well.

Suggested Reading About Modern Data Management

Check our recommended reading list for practical insights and easy-to-understand resources to help you establish good data practices in your organization. Proper data management is not simple – learn foundational concepts to discover helpful solutions to your data challenges.

- Insurance Data Analytics Implementation Guide

- Approaching Digital Transformation in Insurance

- Mapping Data in Excel: Why You Shouldn’t Do That

- [Guide] Building Your Own Record Linkage Solution

- Normalizing Names of Companies, Vendors, and more

- Creating a Canonical Record Set For Efficient Data Management

RecordLinker uses Machine Learning to make your data conversion and management painless.

Auto-map your records during system migrations (e.g. writing companies and parents), identify wildly different spelling variants as a single entity, bulk-create missing companies and configure employees in your core system. Standardize entire data marts.

To learn more about how RecordLinker can help you improve the quality of your data, request a free demo!