Reference Data Management in Agency Management Systems: Rethinking Administration

The Evolution of Reference Data Management in Insurance?

Larger insurance brokers can’t handle the consequences of unsustainable entity management through transformations in the BI layer or in a data mart. Your Business Intelligence and reporting are secondary to your core business systems.

At the same time, the evolution does not have to be about wholesale replacement of existing processes. Low-risk implementation and quick time to value are possible!

Understanding the Agency Management System Reality

Agency Management Systems serve as the transactional source of truth for insurance brokerages. Whenever brokers work with a client, whenever they bind a policy, and store that bound policy, this is the source of transactional truth within the organization.

So AMS are, and must remain, the source of truth for critical reference data:

- Carrier hierarchies and relationships

- Employee records and permissions

- Lines of business

- Office locations and time zones

- Broker/Intermediary information

- Bound policies

The challenge isn’t with core systems’ ability to store and use this data – it’s with the tools they offer to create and manage reference records

Agency Management Systems in insurance are way more than a space for storing data, they are the very systems that are used operationally: by producers, by line account managers etc. Even if you have a data mart, and a Business Intelligence layer, the data travel path always begins in your AMS; this is where the new data entries get created.

There is also hardly ever one set of golden records in a given organization. Reference data is always splintered between these transactional (core system) and BI levels. Maybe there’s even some external layer of reference data or something to compare your reference data against like AM Best for carriers.

Free Book: Practical Guide to Implementing Entity Resolution

Interested in implementing an in-house record matching solution with your own development team without using any outside vendors or tools?

Multiple AMS Installations

Sometimes you may even have multiple Agency Management System installations either from the same vendor or different ones. Brokers acquire agencies, and keep separate AMS installations for main regions or keep, for example, both Vertafore AMS360 and Applied Epic, converting acquired AMS360 agencies into the destination AMS360, and Applied Epic agencies into the destination Applied Epic.

Conversions and data mapping are broader topics, which you can optimize, whether you migrate into AMS360 or convert to Applied Epic. We mention data conversion here, because a lot of data administration is happening during that time post-M&A.

The fact is that no matter how many installations you have, these are your transactional sources of truth. For now, let’s look at capabilities for pure reference data management in Agency Management Systems.

Why Your AMS Fails in Reference Data Management?

You can’t just rely on manual entity management, can you? As long as you need to create or update a few records, you are safe.

The moment you start dealing with updates counting upper two digit or three digit, manual click-by-click data administration reveals a huge scalability pain. To set up an employee properly per your data standards, it does take quite some time, and to set 50 can easily take 2 days.

Why does it happen?

- It happens because most Agency Management Systems carry a lot of technical debt. They have been developed more than 10-15 years ago.

- Most importantly, vendor’s customers, or their NPS scores, are not focused on data administrators.

At RecordLinker we tend to call data admins (much like data conversion teams by the way) ‘the silent teams’ for a reason. They get very little recognition, and are rarely known by stakeholders higher in the organization. If you’d like to find out why data admins are important, listen to this episode of The Insurtech Leadership Podcast, where Roman, our founder and CEO made a guest appearance.

The Unseen Data Heroes of Insurance – Listen to Our Guest Episode

Our founder, Roman Stepanenko, shares insights into challenges of data administrators and data conversion teams in insurance.

Discover the gaps in the process, and the reality of manual workflows of insurance's data people. They are some of the most hard-working and unnoticed 'silent teams'.

Data conversion analysts, business systems analysts, implementation specialists, and data admins keep large brokers going after agency acquisitions.

Why Are AMS Data Admins an Overlooked Group of Users?

Okay, but let’s get back to the core problem with insurance core systems. Why do data admins lack proper tools and their workflow feels suboptimal?

This is because a given insurance brokerage might have 500 account owners / CSR / producers. There are three, maybe five data administrators responsible for converting newly acquired agencies into your core system and ongoing upkeep of your reference data. Sometimes it’s outsourced to a third-party outsourcing company.

So from the point of view of the vendor of the core system, they always devote the majority of the efforts towards satisfying the largest surface area i.e. user-facing front-end is made for everybody else. When it comes to data admins, they are not in a role known to bring direct ROI to the business.

What Are the Consequences for Your Data Management?

As a result,the internal screens used by these few people are not optimized for throughput and usability. Agency Management Systems hardly provide any validational kind of data quality reporting across all of the relevant reference entity types.

A few questions about data admins quality of life:

- How quickly can you find a list of employees who have the same role?

- How quickly can you find a list of different employees that have, for some reason, the same email?

- How quickly can you review access rights across your whole organization that corresponds to producers?

- How quickly can you get a report for outdated company names from your core system?

The real answer is they can’t.

So, this is where the task of management of the golden records in your core systems comes into play. For RecordLinker this is an area of focus. We provide a bi-directional integration via API with your core system (we partner with Vertafore and Applied Systems).

The Classic MDM Trap

Historically, organizations facing reference data challenges have been presented with a false choice:

- Continue struggling with limited administrative tools in their core system

- Implement complex MDM solutions that pretend to become new sources of truth

It’s nice to integrate your Business Intelligence into a Snowflake, it does help with reporting. At the same time, you cannot pretend that companies don’t change, don’t change names, and that new employees don’t get created and edited. You need to do the work with actual transactional data in your AMS.

This MDM approach often creates more problems than it solves:

- Increased system complexity

- Data synchronization challenges

- Disrupted workflows

- High implementation costs

- Rigidity and resistance to change

At RecordLinker we believe that there is a better way to improve reference data management with quick onboarding, short time to value, and low implementation risk.

Modern non-diruptive reference data management is about enhancement rather than remplacement.

New Paradigm: Wingman MDM – Your Administrative Hub

Rather than replacing or competing with core systems, we decided to emerge as a modern solution serving as an administrative hub while respecting the AMS as the source of truth. This approach fundamentally changes how insurance brokers can tackle reference data management.

Viewing of the data you have from your core systems and ability to edit entities by tight API-based integration is the way to go. RecordLinker unlocks efficiencies for P&C insurance brokers thanks to partnerships with Applied Systems (Applied Epic) and Vertafore (AMS360).

RecordLinker can effectively act as a Wingman MDM – letting your Agency Management System play the main hero. Our platform for data management remains a complementary partner who only steps in to help your data admins do the work in your primary source of truth, your AMS.

The Reference Data Hub Advantage

An administrative hub approach offers:

- Streamlined management capabilities without system disruption

- Enhancement of existing workflows and processes

- Reduced implementation risk

- Faster time to value

- Greater user onboarding and acceptance

How Our Administrative Data Hub Transforms Operations

1. Empowering Data Administrators

Administrative hubs provide tools that dramatically improve efficiency:

- Consolidated viewing of all reference entities

- Draft mode for changes

- Bulk editing capabilities

- Change approval

- Quality control mechanisms

2. Maintaining System Integrity

By respecting the core system’s authority, hubs ensure:

- Clean bi-directional synchronization

- No competing sources of truth

- Preserved system relationships

- Well-maintained data integrity

- Reduced risk of errors ending up in production

3. Enabling Scale in AMS Entity Management

RecordLinker’s Wingman MDM approach supports growth by:

- Streamlining large-scale updates

- Support for multiple instances of AMS

- Enabling project-based work

- Facilitating team collaboration

- Maintaining consistent standards

Real-World Impact of Improved Data Administration

But what does having a data management companion like RecordLinker ultimately offer? What are the business benefits of transforming how your data admins work with your AMS entities?

Administrative hubs especially excel during periods of change and growth activities:

- M&A activity followed by new agency integration

- Geographic expansion

- Organizational restructuring

- Existing system consolidation

- System migration

Improving Operational Efficiency

Insurance agencies using administrative tools enjoy:

- Reduced overhead in their data admin teams

- Faster entity updates

- Improved data quality

- Better resource utilization

- Better compliance down the line

- Strategic agility

Implementation Considerations for Improved AMS Data Administration

The future of reference data management in Agency Management Systems lies not in replacement but in enhancement.

When choosing the right solution, look for tools that:

- Respect existing system authority as the primary source of truth

- Operate on AMS records rather than transform them elsewhere

- Provide clear value-add capabilities

- Offer bi-directional synchronization

- Cover the high-impact areas (e.g. issuing papers and employees)

- Enable efficient bulk operations

- Allow gradual adoption

- Support team workflows

- Offer staging and approval workflows

This approach to data administration represents a shift in how we think about reference data management in insurance. It promises better results with less risk and disruption than traditional approaches. By adopting solutions that respect Agency Management Systems’ authority while providing powerful administrative capabilities, insurance brokers can transform their reference data management for the better in no time.

Suggested Reading about Data in Insurance

Take a look at our recommended reading list for practical insights and easy-to-understand resources to help you establish good data practices in your organization. Proper data management is not simple – learn foundational concepts to discover helpful solutions to your data challenges.

- Digital Transformation in Insurance

- Artificial Intelligence in the Insurance Industry

- Simple Data Analytics for Insurance Agencies and Brokers

- Mapping Data in Excel: Not The Best Thing To Do

- Data Conversion: In-House, Outsourcing, and Solutions<

- [Guide] Building Your Own Record Linkage Solution

Problems with Converting Acquired Agency’s AMS Data?

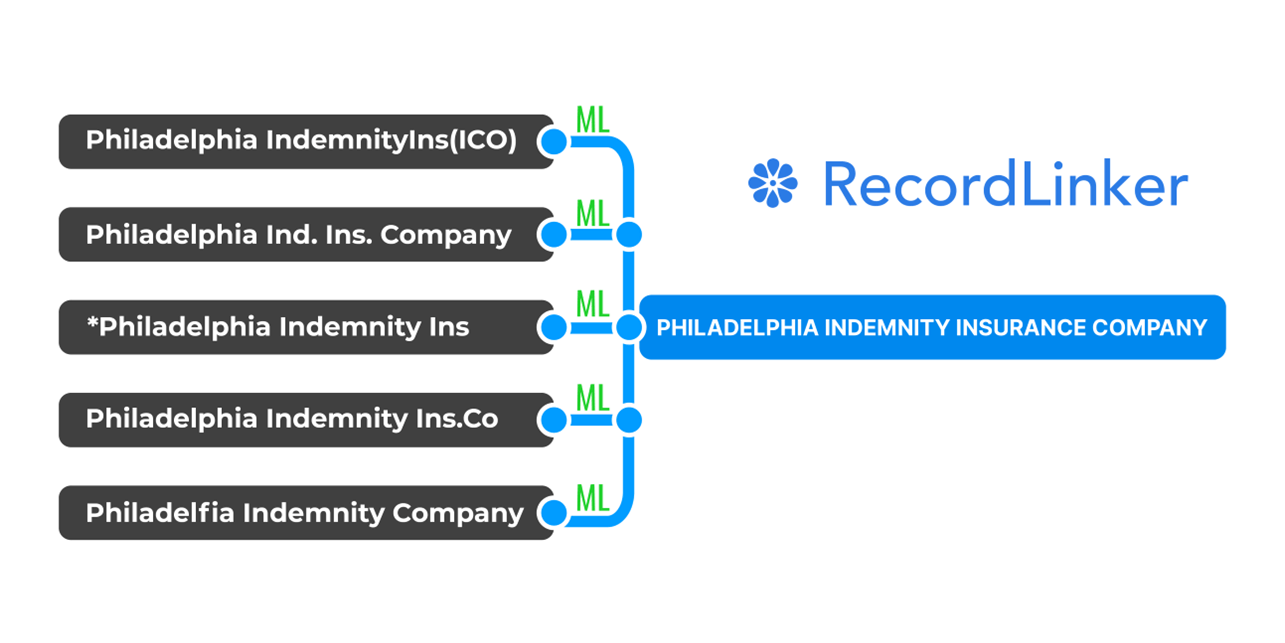

RecordLinker is not just a data management platform! We are primarily known for helping some of the top 100 P&C brokers with their data conversion and map issuing papers. Recordlinker uses Machine Learning to make data conversion painless. We easily handle conversion projects for systems like AMS360, Applied Epic, Sagitta, BenefitPoint, and more.

Feel free to ask us for a live demo!

You can reliably cut conversion project times with ML from weeks to days!